Compare Car Insurance quotes within minutes and see how much you could save.

- You could save up to £504* on your car insurance

- Compare quotes from over 100+ leading insurers

- Get tailored car insurance quotes in minutes

*51% of consumers could save £504.25 on their Car Insurance. The saving was calculated by comparing the cheapest price found with the average of the next five cheapest prices quoted by insurance providers. This is based on representative cost savings from September 2023 data. The savings you could achieve are dependent on your individual circumstances and how you selected your current insurance supplier.

PROVIDERS

Compare Car Insurance quotes from 110+ major UK Insurers.

What is Car Insurance?

Car insurance is where insurers provide financial assistance if you have a car accident or if your car is stolen. It’s like having a financial co-pilot, ready to handle unexpected bumps in your journey.

You’re legally required to have at least basic coverage, known as third-party insurance. (Even if you don’t drive it). The only exception is if you officially declare your car as off the road.

Compare your car insurance options today with Monefi.

What type of car insurance do I need?

Comprehensive car insurance

Comprehensive car insurance is your all-in-one coverage, offering a wide safety net. It protects against theft, accidents, and more. Think of it as your vehicle's guardian, covering repair costs and providing peace of mind.

Third party, fire and theft

Third-party, fire, and theft insurance covers damage to others' property, fire damage, and theft of your own vehicle. It's a balanced option, ensuring peace of mind without the complexity. Monefi simplifies this choice, empowering you to drive confidently.

Third party only

Third-party only insurance is the essential coverage required by law. It protects you from liability for injury or damage to others and their property. While basic, it provides legal compliance and financial protection.

Why compare car insurance with Monefi?

Our commitment is to simplify the process and offer you the best.

Save more and avoid overpaying

Save up to £490* when purchasing new policies or making the switch with us. We’re here to ensure you get the most value for your money.

Get reliable quotes online

Effortlessly compare quotes from over 100 leading car insurers. Click on “Get a quote,” and within minutes, find the most suitable coverage for your car.

Tailored advice and support

Make sure you get the coverage you need wether it’s fully comprehensive or third party, Monefi has you covered.

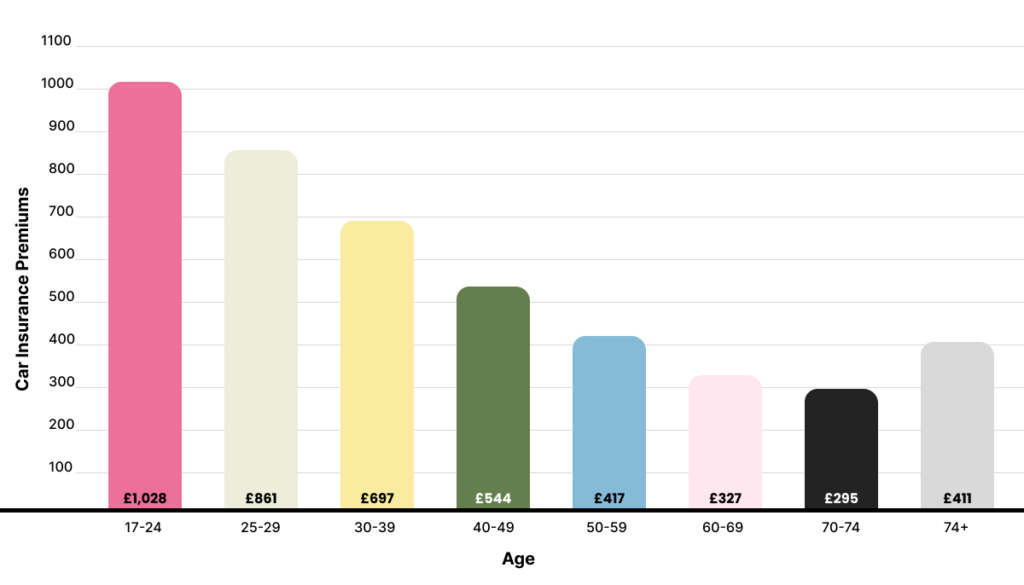

Average Car Insurance premiums:

What information do I need to get a car insurance quote with Monefi?

Getting car insurance quotes with Monefi is simple! We just need a few details from you to tailor the perfect coverage:

Your Details and Driving Licence

Basic details like your job, age, address, and those of any named drivers. We’ll also need info on your driving licence type, its duration, your driving history, and any previous claims.

No-Claims Discount (NCD) History

Maintain a clean claims record, and your insurer will acknowledge it with a no claims discount. This discount serves to lower the cost of your premium. Tell us about your no-claims discount – it helps in getting you the best prices.

Car Details

Provide the car’s registration number if you have it. If not, no worries; the make and model will do. We’d also like to know the age of the car and any modifications you’ve made.

Car Usage Details

Let us know if it’s for social, commuting, or business use, and estimate the number of miles you’ll cover in a year. Additionally, share where you plan to keep the car at night for security reasons.

At Monefi, we make the car insurance process straightforward. Just a few details, and we’ll tailor a quote that suits you perfectly. Ready to hit the road with confidence? Let’s get started!

What affects your Car Insurance premium?

Driving History.

A clean record with no accidents or violations generally results in lower premiums, while a history of claims or infractions may lead to higher costs.

Vehicle Type.

The make, model, and engine size of your car impact premiums. High-performance or luxury vehicles tend to cost more to insure.

Age and Experience.

Younger, less experienced drivers typically face higher premiums, while older, more experienced drivers enjoy lower rates.

Location.

Where you live matters. Urban areas with higher traffic and crime rates often have higher premiums than rural areas.

Annual Mileage.

The more you drive, the higher the risk, which can increase your premium.

Coverage Level.

Comprehensive coverage is more expensive than basic coverage.

Claims History.

Previous claims can affect your premium. If you’ve made claims in the past, you may pay more.

Security Measures.

Where you live matters. Urban areas with higher traffic and crime rates often have higher premiums than rural areas.

No Claims Discount (NCD).

Building a history of no claims can result in significant discounts on your premium.

Occupation.

Where you live matters. Urban areas with higher traffic and crime rates often have higher premiums than rural areas.

How can I get cheaper car insurance today?

Achieving cheaper car insurance is possible through various strategies that can result in a more budget-friendly quote:

Trim down the extra covers

Consider omitting add-ons such as breakdown cover and car keys cover. These extras usually come at an additional cost, and cutting them out might be more economical if you can cover these expenses out of pocket.

Increase your excess amount

A straightforward method to lower your insurance expenses is by increasing your voluntary excess. However, it's crucial not to raise it to an amount that becomes financially unmanageable for you.

Exploring Telematics

Telematics policies, often referred to as black box car insurance, offer an opportunity for younger and less experienced drivers to earn reduced premiums by demonstrating responsible driving habits.

Avoiding Auto-Renewal

While your car insurance may auto-renew at the end of the term, it's wise to explore other providers online. Comparing quotes can often lead to discovering a more cost-effective deal.

Annual Payments

Although paying an annual lump sum for your car insurance might appear as a significant upfront cost, it generally turns out to be less expensive than monthly instalments.

Secure Parking

Reduce insurance costs by parking your car off the road when not in use. Optimal overnight parking is in a secure, locked garage, offering added savings on your insurance.

Trim down the extra covers

Consider omitting add-ons such as breakdown cover and car keys cover. These extras usually come at an additional cost, and cutting them out might be more economical if you can cover these expenses out of pocket.

Increase your excess amount

A straightforward method to lower your insurance expenses is by increasing your voluntary excess. However, it's crucial not to raise it to an amount that becomes financially unmanageable for you.

Exploring Telematics

Telematics policies, often referred to as black box car insurance, offer an opportunity for younger and less experienced drivers to earn reduced premiums by demonstrating responsible driving habits.

Avoiding Auto-Renewal

While your car insurance may auto-renew at the end of the term, it's wise to explore other providers online. Comparing quotes can often lead to discovering a more cost-effective deal.

Annual Payments

Although paying an annual lump sum for your car insurance might appear as a significant upfront cost, it generally turns out to be less expensive than monthly instalments.

Secure Parking

Reduce insurance costs by parking your car off the road when not in use. Optimal overnight parking is in a secure, locked garage, offering added savings on your insurance.

What types of cars can I insure?

Wondering about the cars Monefi can cover? We’ve got you covered for most types, but if your wheels are a bit unique, you might need specialised coverage.

Classic Cars:

If your car is a classic (over 15 years old and valued over £15,000), we've got you covered. Classic car premiums are usually more affordable than standard policies, thanks to their lower speed limits and the dedication of classic car owners to keep their treasures in top shape.

Sports Cars:

For those sleek, performance-oriented vehicles, our coverage is available. Keep in mind, premiums might be a bit higher due to the powerful engines and higher speeds of sports cars, increasing the likelihood of accidents statistically.

Modified Cars:

Got a car with customisations like unique bodywork or engine upgrades? We've got coverage for that too. Keep in mind, modifications classify your car as a higher risk, affecting the cost of your coverage.

Imported Cars:

If you've brought a car from abroad, we understand the unique challenges. Imported cars can be more expensive to insure due to higher repair costs and potential modifications to meet UK regulations, adding complexity and risk for insurers.

Electric Cars:

Cruising in a battery-powered wonder? We've got coverage for electric cars. While they may be a bit more expensive to repair, we ensure them to be tailored to your individual requirements.

Hybrid Cars:

If you're into fuel-efficient, hybrid, or alternative fuel vehicles, we're on board. Premiums will vary based on your policy, car, and driving habits. Some insurers offer special deals for green and hybrid vehicles, so explore your options before choosing the right policy.

Classic Cars:

If your car is a classic (over 15 years old and valued over £15,000), we've got you covered. Classic car premiums are usually more affordable than standard policies, thanks to their lower speed limits and the dedication of classic car owners to keep their treasures in top shape.

Sports Cars:

For those sleek, performance-oriented vehicles, our coverage is available. Keep in mind, premiums might be a bit higher due to the powerful engines and higher speeds of sports cars, increasing the likelihood of accidents statistically.

Modified Cars:

Got a car with customisations like unique bodywork or engine upgrades? We've got coverage for that too. Keep in mind, modifications classify your car as a higher risk, affecting the cost of your coverage.

Imported Cars:

If you've brought a car from abroad, we understand the unique challenges. Imported cars can be more expensive to insure due to higher repair costs and potential modifications to meet UK regulations, adding complexity and risk for insurers.

Electric Cars:

Cruising in a battery-powered wonder? We've got coverage for electric cars. While they may be a bit more expensive to repair, we ensure them to be tailored to your individual requirements.

Hybrid Cars:

If you're into fuel-efficient, hybrid, or alternative fuel vehicles, we're on board. Premiums will vary based on your policy, car, and driving habits. Some insurers offer special deals for green and hybrid vehicles, so explore your options before choosing the right policy.

How much does car insurance cost?

The cost of your car insurance can vary a lot because it’s based on how much risk the insurance company thinks they might have to deal with when covering you. There are many things that can affect how much you pay for car insurance, but here’s a basic idea of what the typical car insurance in the UK costs.

The lady who I spoke to was brilliant. She was lovely and pleasant whilst being professional and fully informative. She was not pushy at all. She certainly had the right attitude and was engaging. If everyone was like her it would be perfect.

Christine Notley

This was the easiest transaction I’ve had in a long time, the customer service was amazing and very helpful and nice to talk with, would highly recommend the company to friends family etc, fantastic customer service. 5 stars from me.

Zoe Mary Hall

Mr Gower was very professional and found the right cover for me. He was polite and engaged in conversation, explained everything easily.

Callum Dobson

Frequently Asked Questions

To find your car insurance due date:

- Check Documents: Look for renewal or expiration dates in your policy documents.

- Contact Provider: Ask your insurer via phone or email.

- Online Account: Check your insurer’s website if you have an online account.

- Automatic Renewal: If set up, your insurer will notify you.

Knowing this date is crucial for continuous coverage. Contact your insurer if you’re unsure.

Gap insurance is a protection you can get when you buy a new car. Its purpose is to cover the gap between what your car insurance would give you if your car is stolen or severely damaged (like in an accident) and the amount you paid for your car.

Example:

- Imagine you’ve just spent £15,000 on a car, either by paying upfront or through a finance plan. You drive the car home, but a week later, it’s either stolen or badly damaged in an accident.

- However the insurer believe your car is now worth only £10,000 because cars lose value quickly. This means you’re left with a £5,000 loss, or worse, you might owe your car finance company £5,000 (plus interest) for a car that’s no longer usable.

- In cases where your car is a total loss, Gap insurance (short for “guaranteed asset protection”) steps in. It works alongside your regular car insurance to fill the gap between what your car insurance pays and what you need to recover financially and get back on the road.

The cheapest and most convenient way to pay for your car insurance is to do it all at once, once a year. This way, you won’t have to pay any extra interest charges, and you can forget about it for a full year.

To find your car insurance due date:

- Check Documents: Look for renewal or expiration dates in your policy documents.

- Contact Provider: Ask your insurer via phone or email.

- Online Account: Check your insurer’s website if you have an online account.

- Automatic Renewal: If set up, your insurer will notify you.

Knowing this date is crucial for continuous coverage. Contact your insurer if you’re unsure.

Gap insurance is a protection you can get when you buy a new car. Its purpose is to cover the gap between what your car insurance would give you if your car is stolen or severely damaged (like in an accident) and the amount you paid for your car.

Example:

- Imagine you’ve just spent £15,000 on a car, either by paying upfront or through a finance plan. You drive the car home, but a week later, it’s either stolen or badly damaged in an accident.

- However the insurer believe your car is now worth only £10,000 because cars lose value quickly. This means you’re left with a £5,000 loss, or worse, you might owe your car finance company £5,000 (plus interest) for a car that’s no longer usable.

- In cases where your car is a total loss, Gap insurance (short for “guaranteed asset protection”) steps in. It works alongside your regular car insurance to fill the gap between what your car insurance pays and what you need to recover financially and get back on the road.

The cheapest and most convenient way to pay for your car insurance is to do it all at once, once a year. This way, you won’t have to pay any extra interest charges, and you can forget about it for a full year.